Hello golf stakeholders:

Welcome to the post-Labor Day stretch of the season which is us up north winding things down and the counter-seasonal markets preparing for their peak winter season and all those (golf) snowbirders. The August rounds are “in the books” (at least for our GMRC subscribers, you won’t have any visibility until the end of this month) and that represents ~71% of annual rounds national using the last 5-yrs average.

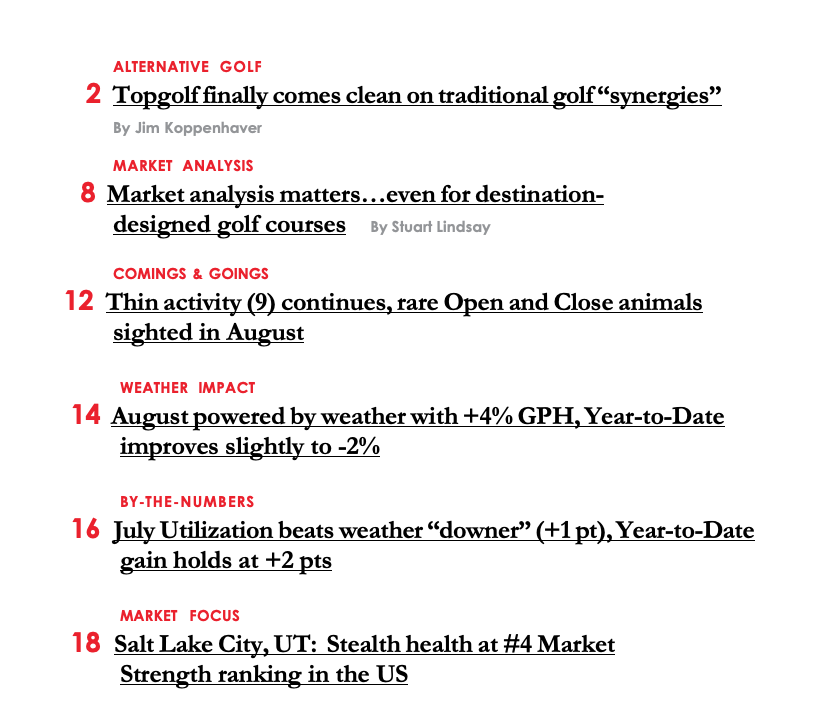

Publisher Jim K. gets the lead this month with his piece examining and opining on what the Topgolf spin-off means about the much-touted synergies between “alt golf” and “traditional golf.” While there are other reasons financially and regarding how markets have valued the grand experiment of “Modern Golf” (ironically the ticker symbol of MODGOLF will likely disappear after the divorce), Jim explores the hypothesis that golfertainment would bring “masses” of non-players into the sport which would benefit equipment providers such as Callaway. The creation of this virtuous cycle to grow golf and turbocharge Callaway’s core equipment sales appears to lack any quantitative proof which further erodes the wisdom of the tie-up in the first place. This isn’t the complete or end of the story but it’s an interesting sidebar to the primary bets that don’t appear to be valued by investors 3 years in.

Contributing Editor Stuart Lindsay looks at a couple of recent course closures announced which are bucking the current “rising tide lifts all boats” trend for golf operations suggesting that poor market dynamics (either at inception or years later due to changing demographic and local labor market erosion) are just as deadly as poor management and unwise financial decisions. As only Stuart can, he weaves in reference to the Eagles’ Hotel California classic which resides in the market of closed course Primm Valley in Nipton CA (he even gets a Mark Twain reference in there as well with the 2nd closed course, Blue Fox Run, in Avon CT).

See below for the headlines to each of our recurring sections from the regional August weather impact map (another downer) to By-the-Numbers which provides the July and Year-to-Date results for Rounds and Utilization. We’ve already compiled the August golf operations performance scorecard “preview”, courtesy of our Golf Market Research Center early-responders. It suggests that Golf Revenue and Rounds will match or slightly exceed the favorable weather results in this issue which would result in gains in key metrics GRevpAR and Utilization (in other words, weather helped but we also helped ourselves). If you want to know those numbers on a regular basis, you can either participate in GMRC (course operators) or sign up for a Publications Membership (everyone else).

If you know of associates who would benefit from the topics and insights covered in this issue, feel free to forward this email and encourage them to register on the Pellucid website (http://www.pellucidcorp.com/news/elist) to join the discussion and healthy debate.

For those of you who would like our recently-updated complete US Golf Markets Strength Scorecard, it’s part of the Pellucid Publications Membership which can be ordered here (not available as a solo report). Delivered in an Excel workbook format, it provides key facts on all 207 DMAs for both the Size rankings (Rounds, Golfers, Holes) and the Strength scores and rankings (Pop Growth, Income Growth, Play Rate (Rds per Capita per Yr), Pub Golfers per Pub 18-hole equivalents and % Utilization). While the size rankings may not surprise you, there are guaranteed surprises when we factor out size and score every market by strength!

© Copyright 2024 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.