Hello golf stakeholders:

With all of the industry “season-opener” conferences now behind us, it’s time to start thinking about specific programs and execution for the upcoming season (northern climes) while the counter-seasonal market operators are already in the “thick of things” for ’25.

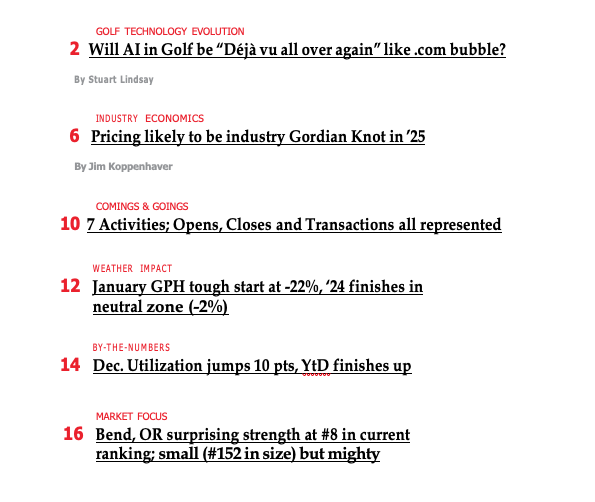

Stuart Lindsay headlines this month as he gathers facts and applies his significant historical knowledge of golf industry technology to predict whether AI represents a “new dawn” for the industry or will repeat the dot com disappointment that played out around the turn of the century. Much like the previous dawning, whether or not we make it to full daylight will rest heavily on the reliability and speed of internet connectivity for the majority of operators.

Publisher Jim K. is supporting cast diving into the fun and controversial topic of pricing for the ’25 season. Coming out of the Orlando bar, meal and hallway conversations, there’s no shortage of opinions and support regarding how much (or if) pricing action the average operator should dial in for ’25 and the multiple paths to get there (rate card changes, differential vs. uniform changes, dynamic pricing, senior rates etc. etc.). Spoiler alert on where he lands, “proceed with caution.”

See below for the headlines to each of our recurring sections from the regional January weather impact (ouch, double-digit down coming off a similar December result) to By-the-Numbers which provides the December and Year-to-Date results for Rounds and Utilization. We’ve already compiled the January golf operations performance scorecard “preview”, courtesy of our Golf Market Research Center (GMRC) early-responders, and the sneak peek suggests that Rounds will take a hit but, similar to December, not decline linearly with the GPH crash. If you want to know those numbers on a regular basis, you can either participate in GMRC (course operators) or sign up for a Publications Membership (everyone else).

If you know of associates who would benefit from the topics and insights covered in this issue, feel free to forward this email and encourage them to register on the Pellucid website (http://www.pellucidcorp.com/news/elist) to join the discussion and healthy debate.

For those of you who would like our recently-updated complete US Golf Markets Strength Scorecard, it’s part of the Pellucid Publications Membership which can be ordered here (not available as a solo report). Delivered in an Excel workbook format, it provides key facts on all 207 DMAs for both the Size rankings (Rounds, Golfers, Holes) and the Strength scores and rankings (Pop Growth, Income Growth, Play Rate (Rds per Capita per Yr), Pub Golfers per Pub 18-hole equivalents and % Utilization). While the size rankings may not surprise you, there are guaranteed surprises when we factor out size and score every market by strength!

© Copyright 2025 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.