So who’s getting rich?

How many of you remember when Crown Books (discount book retailer) was a viable, brick-and-mortar retailer? For those with their hands raised, you likely remember the TV commercial where baby-faced Robert Haft looked at the camera and whined, “Books cost too much, that’s why I founded Crown Books.” The irony of this is that Haft was an heir to his family’s fortune and never in his life had to make a decision between a book and food or clothes but, hey, it was a clever “schtick.”

You may recall that I dedicated the March issue of this year to the subject of pricing and whether we had been keeping up with, or lagging, inflation in our annual Rate Card escalations post-COVID. While the world looks slightly different than then, we’re “feeling” (not quantitative yet) a crescendo of the headline sentiment from the golf community in general. What 45 years in business has taught me is, if the consumer is being taken advantage of, then someone in the industry has to be making/showing escalating and abnormal margin and profit. Having an inside seat at the table of corporate revenue, cost and profit given the sheer volume and diversity of facts that we process and analyze, I’m not seeing the size or breadth of windfall that the industry should be accruing if the consumer’s sentiment is in fact correct.

Since we live in the world of what we can quantitatively support vs. the land of “we think, we feel, we believe”, in this issue I’ll go through:

- How can we determine if we’re making money (or not) on “core golf”? (greens fees, carts, various memberships etc.)

- We’re also playing catch-up (but not much left) on deferred maintenance and replacement for capital assets/expenses as well as having to consider higher financing costs for any previous loans that will roll over

- We should also be taking this opportunity to either put in place or improve our Customer Relationship Management (CRM) and Business Performance Analysis (BPA) capabilities which is where some portion of any current pricing favorability should be being invested proactively. On this point and as it relates to the latter, 10 years ago when we were selling services we were told, “We get the need, we just don’t have the luxury of “discretionary dollars” to do that while now, when we do have the discretionary dollars, the reason has changed to, “We’re doing so well that we’re back to the “open the doors and show ‘em a good time” operating model. Go figure…

So, having given away the answer to the growing golfer complaint about golf costing too much, our subscribers can keep scrolling down to get the supporting facts and insights while everyone else can just pocket the answer or you too can get the supporting facts one of three ways:

- Subscribe to the comprehensive Pellucid Publications Membership for $495/yr or $45/mo (annual term), subscribers get access to the following:

- Outside the Ropes monthly digital newsletter

- Annual State of the Industry report portfolio (75-slide PowerPoint presentation plus online access to Jim/Stuart Orlando presentation video)

- Geographic Weather Impact Tracking (US, 45 regions, 61 markets) or Cognilogic for Golf Playable Hours/Capacity Rounds for individual facilities

- National Consumer Franchise Health Scorecard (expanded data and tables underlying this issue’s summary figures)

- Subscribe to OtR, 12 monthly issues for $250/yr or $25/mo (annual term), with a money-back guarantee if you’re not satisfied at any time during your subscription. Subscribers also get access to the historical archive of past issues (last two years) via the members-only section of the Pellucid website

- Subscribe to Golf Market Research Center (for operators wanting a combination of insights and action tools) – Here’s what’s included in the current “promo package” for either $500 annual or $450 for NGCOA members (or $45/mo or $41/mo respectively):

- Full suite of Performance Tracking reports – Market profile, comparative trends report and 7 KPI scorecard for any month and Year-to-Date for data provided by facility

- Facility-level Cognilogic historical weather impact portal/reports access, Golf Playable Hours & Capacity Rounds by day in current month, by months in current year and by day-of-week in current year with comparisons to Year Ago and the 10-Yr Norm

- Facility-level Foresight 60-day Capacity Rounds forecast, select forecast weather elements (hi/lo temp, daily precip etc.), variance to last year and long-term Normal. Not infallible but better than guessing or trying to collect all that yourself and organize it manually…

- Outside the Ropes monthly e-newsletter (consider this a sample of topics and treatments)

- State of the Industry Presentation, PowerPoint presentation slides of quantitative results and qualitative trends-to-watch as well access to 90-minute PGA Show presentation video

To learn more:

- Click here for 2-page program overview or

- Click here for 15-minute video demo (you do have to register to see video; don’t worry, you’re not signing up for anything)

- Click here to subscribe for a single facility

- Email me for multiple facilities or special situations

How do you figure out the “cost of golf”? (or a reasonable proxy thereof)

We’re currently working on an advisory project for a course operator trying to convince their owners that, on certain “legacy” golf fixed-cost programs, they’re actually selling golf below cost. That work and thinking dovetails nicely into trying to answer the question of whether golf operators are making too much money in the current pricing structures (rate card, season pre-pays, golf packages, protected groups (Srs, Jrs etc.) and levels (how they’re priced or the criteria for protected groups (like 55+ for Seniors etc.) for golf. The fundamental question that must first be answered is, “What is my cost to produce a round of golf?”

When we’ve asked numerous operators over the years how the determine the cost-to-produce a round of golf, the majority opinion is Total Expenses/Played Rounds. What Stuart and I sought to prove out, as one of the core aspects of this recent project, is that this equation has both a flawed numerator and denominator:

- Not all expenses are required to produce a round of golf – As we, and other industry observers and advisors, have seen and pointed out over the years, the typical golf course P&L is a mess of inconsistent line items year-to-year and course-to-course. You don’t need a number of line items in your expense ledger to produce a round of golf (i.e. F&B, Range, Instruction, Pro Shop merchandise sales etc.). If you want to understand what’s referred to as COGS (Cost of Goods Sold) in other industry P&Ls, your expense figure needs to be “skinnied” down to the direct costs (i.e. turf maintenance products & people, some allocation for equipment used, front counter/on-course customer staff etc.). We acknowledge both that there’s art & science here as well as the fact that this still represents the lion’s share of expenses but it does produce a meaningfully different answer to the cost question and, if you’re trying to figure out what selling below cost is, it’s important to get “cost” as accurate as possible. That’s part of the reason we got called into this project, they wanted a rigorous, independent, 3rd party analysis on the economic wisdom of these legacy programs.

- Capacity, vs. played, rounds is the better denominator to determine cost-per-round – Stuart has a great illustration to prove this out. If in ’22 you did 40K rounds against a direct cost of course maintenance and staff of $800K, then your cost-per-round would be $20. If in ’23 your rounds went up to 45K say, behind 10% better weather, and your expenses remained fixed (you didn’t know you were going to get more favorable weather next year) your cost-per-round went down to $18. Did it really cost you less to produce that round of golf (people, equipment, turf applications etc.)? We prefer to use Capacity Rounds (so accounts for weather variance) and using the 10-yr average which smooths out the annual ups and downs. That produces the average amount of use the golf course needs to be prepared for and what moderate-tenured Superintendents generally expect and plan for by the seat of their pants

As part of the larger picture and supporting the topic of this newsletter, when one calculates the cost-per-round for most facilities, they’re making solid margin on weekend rounds, modest margin on weekday rounds & “member discount programs” and thin margin on subsidies (Sr./Jr. Rates, twilight etc.). Applying this math to specific “all-you-can-play” types of programs, what we found here (and likely would see in the majority of cases) is that the Season Pass programs being offered were what we call in Consumer Goods, “loss leaders”. The only problem is that we sell loss-leaders in grocery hoping to make up for it on the rest of the “basket” that we sell at full margin or to buy a shopper’s loyalty. In golf, there’s just not enough other items to shop for to offset selling your core product at a loss. As a result of all of the above, when we look at the average course’s P&L, we see an Operating Margin between 5-15% often driven by how their ancillary rates and discounts (not their weekend or weekday AM/PM rate cards) are managed. Final point, for comparison, the well-run Consumer Goods Manufacturers generally run a 60-65% Gross Margin (sales less COGS) and a 30-45% Operating Margin. Hence, if we call our Operating Margin 10% as an average, you can see why no one’s getting rich despite the consumer perception that “golf costs too much.”

CapEx “catchups” – Another part of the reason that operators aren’t swimming in cash.

If you’ve been even casually observant of the industry email dailies (the ones that aren’t focused on the PGA TOUR, who’s fighting with whom or What’s in the Bag), there’s been a non-stop stream of renovations being announced from course physical assets to irrigation systems to clubhouses (buildings, restaurants and simulator installations) and range improvements (mostly TopTracer installs). Colleague Stuart Lindsay recently updated his knowledge of the course renovation space when invited to speak to the Golf Course Builders Association of America. In discussion with their members during the event, attendees reported and shared that costs have gone up since the previous installs by 25-50% vs. 10 years ago. In addition, because courses had no money, the number of providers of these services has been winnowed significantly. So, the intersection we currently have is more courses, now with money, chasing a smaller universe of service providers whose cost has escalated significantly. As a result, it seems to me that for 90%+ of the courses we deal with, initial “windfall dollars” (from higher rounds and higher pricing of the past 3 years) have been directed to these big projects. Factor in as well the higher interest rates and that seems to have pushed more operators into funding these with windfall cash than financing them so, once again, more rounds and higher prices are being funneled directly and quickly into improving what I call the “physical plant” which is catch-up spending.

Another destination of any incremental funds is a reserve to offset future higher lending costs for loans and obligations that will need to be refinanced in the next 1-3 years. Like all of us as consumers, the cost of capital has gone up ~2x given today’s interest rates vs. as recently as 2 years ago. Some number of operators we’ve talked with have indicated that they’re setting aside funds for that (somewhat) known future obligation. This is smart but it also reduces the “excess profits” which may be perceived by golfers in current higher pricing but, again, it’s more that the operators are getting financially healthier and less at risk of a future financial liability that will jeopardize their health and/or ability to exist as a golf course in the next 1-5 years (many having just been through that near-death experience unprepared).

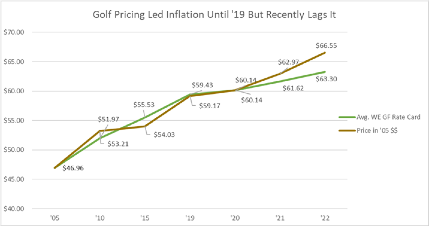

In closing on this topic, and in fairness overall, some number of operators are reporting short-term margin improvement and taking some of the revenue favorability to the bank. This is no different than the food manufacturers I work with and observe financially in my “other life” which have generally seen margin improvements of 3-5 points over the ’21-’23 period. The game for them is they want to tout those results to their investors but hide them from retailers (hard because they’re generally public companies with quarterly investor reviews, annual reports which retailers can and do follow closely) and consumers (easier because the average consumer isn’t reading the Wall Street Journal and tracking the financial performance and health of the Fortune 100 food manufacturers). The game, if you will, is to take marginal gains in margin during rising tides while avoiding pricing the consumer out of the market or giving them reason to either switch brands or stop consuming the product or category altogether. That’s the delicate balancing act before us but, as I highlighted in the July OtR and illustrated in the table from that issue below, in the most current cycle our annual price increases have been trailing general inflation rates so, so far, it appears we’re managing the delicate balance adequately:

Still not catching up or getting out in front of CRM.

The one “blind spot” that I see repeatedly in the current cycle and where to invest incremental dollars is that operators, by and large, are not setting aside even minimal levels of funding for Customer Relationship Management and Business Performance Analysis. On the former, this consists of being able to identify and quantify Retained, New and Lost golfers (each month), whether they’re winning or losing the battle of churn (net gain/loss of golfers and dollars comparing New to Lost) and loyalty levels to their course (what share of their total golf rounds are given to your course vs. others in your customers’ rotation; is it growing or declining?). The answers to those questions are buried in your Point-of-Sale system (if the PoS platform has the capability to make a customer-to-transaction tie and you’re using it to identify customers for as many transactions as possible) but, trust us, mining them isn’t easy. We’re doing collaborative work with a technology partner and several of the PoS providers to not only unlock those important secrets but also to be able to semi-automatically act on them (i.e. identify at end of month what Defectors from the previous year remain, pick an email message and send it to the Defectors for which you have email addresses (should be 90%+ if you’re diligent in contact info collection)). I’ll give you that, currently, taking the insights to execution has been problematic but we’re aiming to navigate that final mile and make it easy and frictionless with a combination of technology partners that are integrated in collection of data, categorizations of customers and automated feed to the executional tools (broadcast email system, text etc.).

Regardless of our success or failure in this area, operators must spend some time, effort and money in ’24 for customer programs and messaging to fight the battle for share-of-golfer for short-term gain as well as “consolidating their position” for that inevitable future year where demand slackens and consumers demand more price discipline and containment. As I’ve said previously (multiple times), golf courses should not be that different than other industries of similar sophistication and maturity which spend between 2.5-7.5% of gross sales annually on Marketing and Customer Development. The “average” golf facility is an ~$1.25M annual gross revenue which would mean an investment of $62.5K at the spending level midpoint. While I don’t know the current average investment level number in any way quantitatively, I would be willing to bet significant money that <10% of US golf facilities spend at that level. As I said in the opening paragraph, my comical observation of the circular logic here is that courses in the current economic cycle want to spend all their money on hard/tangible assets and don’t feel the need to “catch up” on their sophomoric CRM and BPA capabilities because golfers are currently beating a path to their door. Now is the opportune time to fix the roof because the sun is shining but…we know that at some point in the future the rain will come and you don’t want to be up on the roof patching when that happens.

If I Were King…

In response to the consumer perception that golf, both historically and in the current cycle, is priced too expensively, the above outlines why no one’s currently “getting rich” off recent price (or rounds) increases. We believe that the majority of operators with which we interact on a regular basis are taking prudent steps to get current on deferred CapEx, insulate themselves from higher borrowing costs for anticipated Yrs 1-3 expenses and taking marginal gains in Operating Margin/Profit with what’s left over. We’d like to see them also take advantage of this tailwind to build muscle and memory in CRM and Business Performance Analysis. Given that we have a vested interest in investment in both those areas, this obviously isn’t an unbiased recommendation but we’ll argue the strength of the facts with anyone that building relationships and a stronger, more loyal consumer franchise is in the operator’s immediate and long-term best interest.

Some of the other signs to look for which are usually harbingers of industries where there’s persistent pricing power and ever-expanding margins are:

- Rapid and extensive consolidation among key stakeholders (that would be equipment consumer companies, golf management companies or owner groups, turf equipment suppliers, services suppliers etc.)

- Escalating and large outside capital interests and investment (private equity, venture capital)

- New, disruptive business models leveraging further cost-reduction using either technology or superior, standardized processes or consolidated market/buying power

I’m not currently seeing any groundswell in any of the above areas as it relates to golf so that also suggests that none of the above entities seem to think there’s a play to address the perception that “golf costs too much” that can be easily of quickly monetized. As we collectively move forward in the next 1-3 years however, now that we’ve caught up on investing in physical assets, hedged our finances and increased (started?) investment in customer relationships, we’ll be well-served to pay attention to annual increases in rate and look for the early signs of golfer resistance as an early warning of when we truly have reached the point where “golf costs too much” but, in my professional opinion and as outlined above, we’re not there yet.

As always, samples of all our publications, reports and services are available on the Reports and Services pages of the Pellucid website. Just as a reminder, this is our last OtR issue of the calendar year but we’ll be back in January with the State of the Industry (SoI) issue. We’re in early planning stages for our 21st consecutive SoI in Orlando, more details to come later this month in a Save the Date note. I hope you had a thankful Thanksgiving filled with family, friends and food in abundance and prepared with love. Looking forward, best wishes for a peaceful, reflective Christmas season and holiday along with a round or two of golf if you live in the land of December Golf Playable Hours or can transport yourself to those lands.

© Copyright 2023 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.