Hello golf stakeholders:

Happy holidays from Pellucid, hopefully most of your Christmas shopping is done as we pen and present our final issue of ’24 today. Merry Christmas to our Christian brethren, wishes for a blessed holiday season, whatever your religious persuasion, and we hope that ’25 brings you happiness, satisfaction, purpose and gratitude in both your personal and professional life.

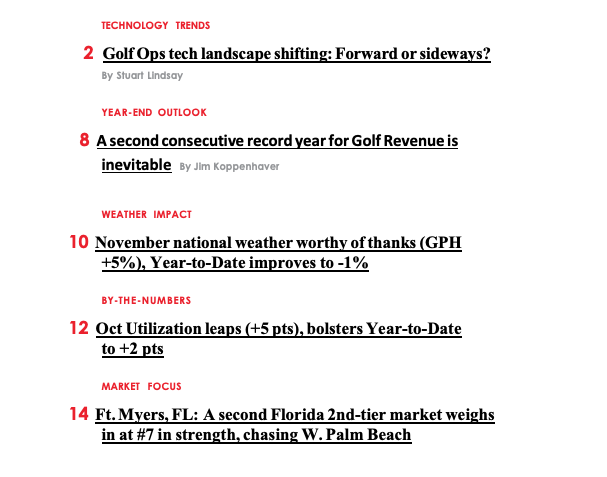

Stuart once again gets the lead this month with a preview of golf industry technology topics that he’s going to cover in our 22ndannual State of the Industry presentation next month in Orlando. While we’re seeing a considerable amount of activity in the tech space, it’s debatable how many and which are moving us forward to continue the post-COVID success we’ve realized in play and participants and which are merely new parties replicating the same technology as legacy providers. As is usually the case, the answer is “It’s a little of both”; read on for Stuart’s take on what he thinks are progressive ideas and tools that could take us higher in ’25 and beyond.

Publisher Jim K. makes “the call” for the ’24 finish on several golf operations Key Performance Indicators using the November results submitted by the Golf Market Research Center (GMRC) participants (confidently) predicting another modern-era record for both Golf Revenue and Rounds. He also touches on the familiar topic of how much of that success is luck (weather-aided) vs. skill (weather-adjusted metrics are actually going higher as well). Similar to Stuart’s article, this is a preview of the quantitative figures that we’re beginning to compile for the State of the Industry for the Pellucid “faithful.” After being labeled the “industry contrarians” for over a decade, our current stretch of being the first (and for many metrics, the only) call on positive numbers will hopefully reinforce our assertion, since the beginning in ’01, that we are merely the “industry realists” following the facts and interpreting them responsibly year after year wherever they may lead us. That said, it’s more fun to be the harbingers of good news than the angel of doom.

See below for the headlines to each of our recurring sections from the regional November weather impact map (crazy good) to By-the-Numbers which provides the October and Year-to-Date results for Rounds and Utilization. We’ve already compiled the November golf operations performance scorecard “preview”, courtesy of our GMRC early-responders, which suggests that it was again widely and significantly favorable on the key metrics of Revenue, Rounds and Rate (trifecta). If you want to know those numbers on a regular basis, you can either participate in GMRC (course operators) or sign up for a Publications Membership (everyone else).

If you know of associates who would benefit from the topics and insights covered in this issue, feel free to forward this email and encourage them to register on the Pellucid website (http://www.pellucidcorp.com/news/elist) to join the discussion and healthy debate.

For those of you who would like our recently-updated complete US Golf Markets Strength Scorecard, it’s part of the Pellucid Publications Membership which can be ordered here (not available as a solo report). Delivered in an Excel workbook format, it provides key facts on all 207 DMAs for both the Size rankings (Rounds, Golfers, Holes) and the Strength scores and rankings (Pop Growth, Income Growth, Play Rate (Rds per Capita per Yr), Pub Golfers per Pub 18-hole equivalents and % Utilization). While the size rankings may not surprise you, there are guaranteed surprises when we factor out size and score every market by strength!

© Copyright 2024 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.