Hello golf stakeholders:

The September revenue & rounds are “in the books” and, as Jim K. points out in his article, that represents, historically cumulatively, ~80% of the rounds contribution for the year nationally.

Contributing Editor Stuart Lindsay headlines this month with a look at a lurking future challenge to sustaining the current rounds, the “Gen X hole” in early career participation which he alludes to as “the elephant in the room.” The gist is, during their formative years (25-44) there were fewer of them (compared to us Baby Boomers) and their participation rate was much lower than us Boomers at that lifestage. As the Boomers age out, you can see the challenge, in those two numbers, of Gen X falling short of being a full replacement and Stuart puts a range on that deficit we’ll likely face in the next 5-10 years. While we’re here, we need to make a correction to Stuart’s article in the September edition that cited the Blue Fox Run course in Avon, CT as closed. The firm handling the auction of the course reached out to tell us it was still operational pre-auction (which happened 9/26 and public articles indicate resulted in a successful, yet-undisclosed bidder).

Publisher Jim K. is supporting cast this month with his projections for the year-end finish for the golf operations sector nationally including Golf Revenue, Rounds, % Utilization, Golf Revenue-per-Available Round and Average Rates (pricing power). He forecasts the year will finish “sneaky long”, quietly setting new modern era records for several of those measures despite no major blowout or blowup months. Pellucid is the only entity in the industry that has visibility to any of the metrics beyond rounds, based on their 3-year collaborative project with ~100 progressive facility owner/operators who participate in the Golf Market Research Center (GMRC) service. Curiously, our $25-$30B annual revenue industry hasn’t historically had a problem with flying blind on knowing the key metrics at the national level (and none of the industry associations have come to its aid).

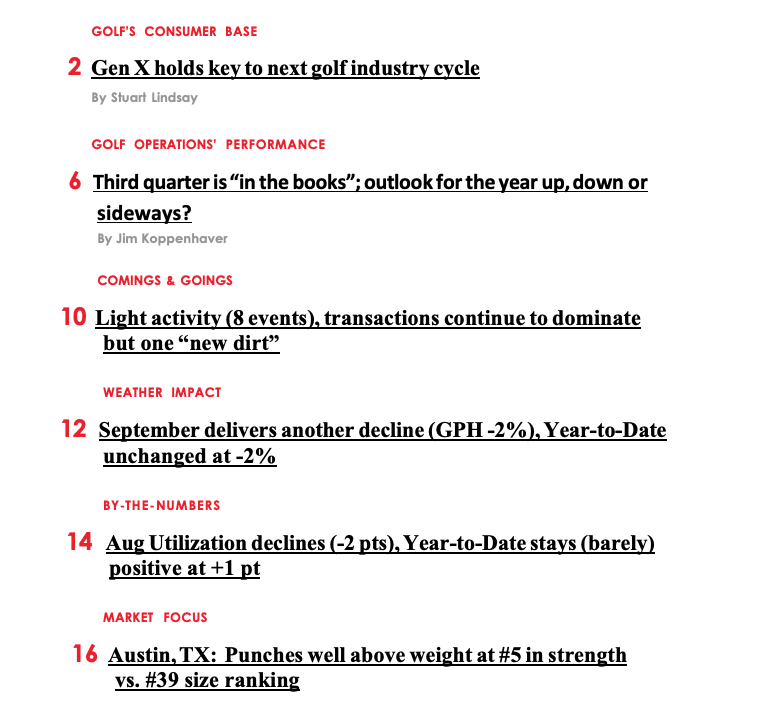

See below for the headlines to each of our recurring sections from the regional September weather impact map (modest down) to By-the-Numbers which provides the August and Year-to-Date results for Rounds and Utilization. We’ve already compiled the September golf operations performance scorecard “preview”, courtesy of our GMRC early-responders. It suggests that, nationally, Golf Revenue will exceed favorable weather while Rounds will likely just mirror it which would result in a GRevpAR gain and % Utilization “push”. If you want to know those numbers on a regular basis, you can either participate in GMRC (course operators) or sign up for a Publications Membership (everyone else).

If you know of associates who would benefit from the topics and insights covered in this issue, feel free to forward this email and encourage them to register on the Pellucid website (http://www.pellucidcorp.com/news/elist) to join the discussion and healthy debate.

For those of you who would like our recently-updated complete US Golf Markets Strength Scorecard, it’s part of the Pellucid Publications Membership which can be ordered here (not available as a solo report). Delivered in an Excel workbook format, it provides key facts on all 207 DMAs for both the Size rankings (Rounds, Golfers, Holes) and the Strength scores and rankings (Pop Growth, Income Growth, Play Rate (Rds per Capita per Yr), Pub Golfers per Pub 18-hole equivalents and % Utilization). While the size rankings may not surprise you, there are guaranteed surprises when we factor out size and score every market by strength!

© Copyright 2024 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.