Hello golf stakeholders:

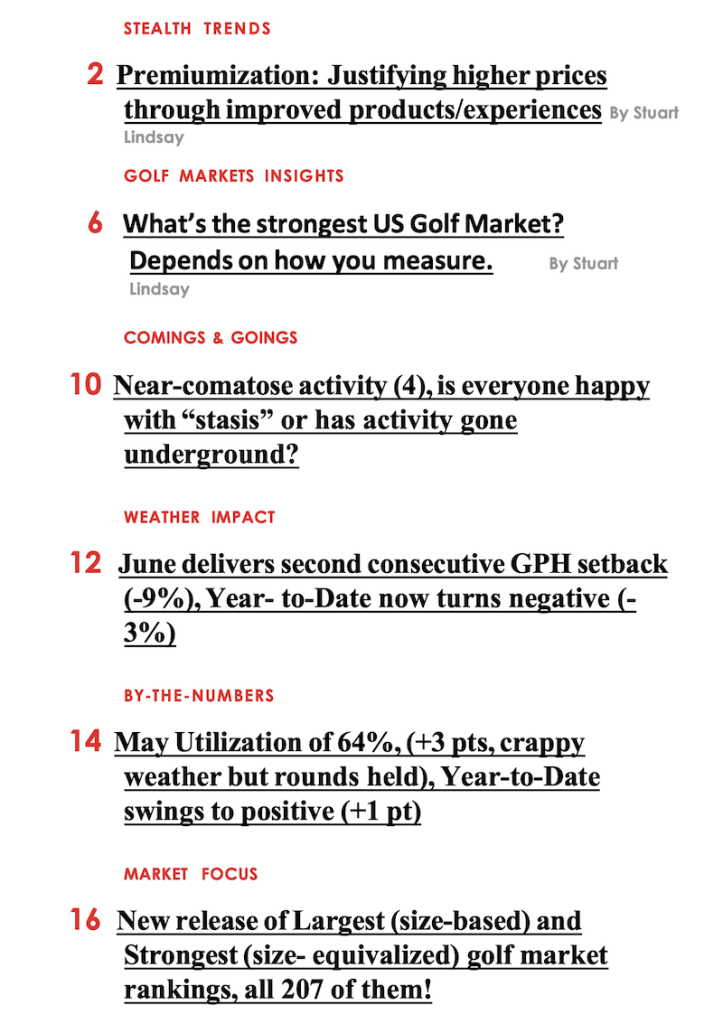

As we head toward the 4th major of the year, The British Open (sorry, I still just can’t bring myself to say The Open Championship with a straight face) Mother Nature has complicated our ’24 season with two months of widespread heat & humidity for golfers to contend with. Regardless, the resurgent demand for golf continues to “play through” the fickle May-Jun weather.

Contributing Editor Stuart Lindsay headlines this month with another new buzzword in the US business lexicon and applies it to the golf industry: “premiumization”. Given Jim’s 35+ year background in Consumer Package Goods, he’s seen this be trendy several times as even the manufacturers of the lowly potato chip aspire to make their product transcendent enough to command a premium price. As Stuart observes, the trick to premiumization is delivering higher perceived value than the price gap to whatever is “standard.” His caution is that we’re increasingly leaning to the higher price points but, in many cases, not delivering the value-added. Down that path lies destruction.

Publisher Jim K. is supporting cast with his piece on evaluating, scoring and ranking the Strongest US Golf Markets which summarizes Pellucid’s upcoming release of the 1-207 ranking of Designated Market Areas (DMAs) for golf operations. Two of the unique features of this bi-annual update of their Top US Golf Markets rankings are, for the first time, they rank all 207 markets, not just the 25 largest and, to do that, they had to figure out how to size-equivalize the metrics so smaller markets competed on equal footing with the major metros and golf destinations. Read on to see what the Top 10 are in strength and how that compares to the Top 10 by size.

See below for the headlines to each of our recurring sections from the regional June weather impact map (read ‘em and weep) to By-the-Numbers which provides the May and Year-to-Date results for Rounds and Utilization. We’ve already compiled the June golf operations performance scorecard “preview”, courtesy of our Golf Market Research Center early-responders. It suggests that Golf Revenue and Rounds will once again prevail over poor weather, taking a hit vs. Year Ago but less than the weather unfavorability. That outcome would be a 2nd strong datapoint for the current trend’s rounds & golf revenue resilience (available only to our GMRC subscribers). If you want to know those numbers on a regular basis, you can either participate in GMRC (course operators) or sign up for a Publications Membership (everyone else).

If you know of associates who would benefit from the topics and insights covered in this issue, feel free to forward this email and encourage them to register on the Pellucid website (http://www.pellucidcorp.com/news/elist) to join the discussion and healthy debate.

For those of you who would like the complete US Golf Markets Strength Scorecard, it’s part of the Pellucid Publications Membership which can be ordered here (not available as a solo report). Delivered in an Excel workbook format, it provides key facts on all 207 DMAs for both the Size rankings (Rounds, Golfers, Holes) and the Strength scores and rankings (Pop Growth, Income Growth, Play Rate (Rds per Capita per Yr), Pub Golfers per Pub 18-hole equivalents and % Utilization). While the size rankings may not surprise you, there are guaranteed surprises when we factor out size and score every market by strength!

© Copyright 2024 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.