The supply and demand of the golf economy are in pretty good balance right now.

Full tee sheets and the financial health of America’s golf courses can attest to that. In our “crystal ball,” we just can’t see a domestic golf course building boom in our future (land in or near population centers is too scarce and expensive). However, relative to previous periods of golf supply expansion, we have seen a modest uptick in the development and construction of new golf courses. The new tracks are disproportionately high-end private and resort courses, many of them special enough to justify their “destination” status.

But perhaps the most noteworthy sign of the health and vitality on golf’s supply side is the considerable investment being made in existing golf facilities.

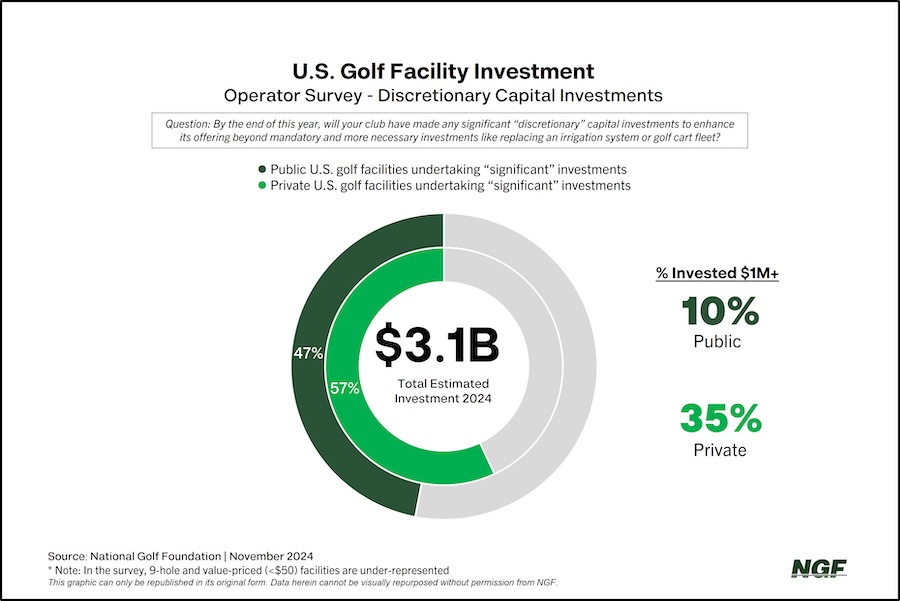

While there are just over 100 new course projects at any stage in the development pipeline, the U.S. is already home to approximately 16,000 courses at nearly 14,000 facilities. And it’s estimated these properties combined have spent about $3.1 billion over the past year or so in significant “discretionary” capital investments to enhance their offerings, from the golf course itself to the clubhouse, infrastructure, technology, amenities, and more.

This does not include expenditures or investments that would be deemed necessary or mandatory, such as the replacement of an aging irrigation system or cart fleet.

In operator surveys conducted over the past several years, approximately 60% of responding private clubs indicated they made a significant capital investment. And the magnitude of that investment surpassed $1 million in about one-third of private projects. Just under half of the public courses surveyed cited significant discretionary capital investments.

Thousands of U.S. golf facilities are continuing to invest in making the current product better for everyone involved.

The scope of improvements is considerable, from a $1 million renovation at Babe Zaharias Golf Course in Tampa, Florida, that included new greens and bunkers at the municipal facility, to the recent $30 million overhaul at East Lake Golf Club, the private club in Atlanta where Bobby Jones learned the game and the FedEx Cup TOUR Championship is hosted.

In assessing feedback from operators and management companies, a key driver is that courses are better positioned financially to reinvest after recent business successes. Another element at play is that – in some cases – courses were overdue for certain investments after having put them off previously. Lastly, many operators are cognizant of the fact that they need to invest in improvements/upgrades to better position themselves to meet the evolving demands and expectations of consumers.

Further investment is on the horizon, as well.

Harbour Town Golf Links in Hilton Head, South Carolina – the home of a PGA Tour stop since 1969 – is closing down in May for a six-month restoration project. Rock Creek Park in Washington D.C., one of three public courses in the nation’s capital, is shutting down for a two-year revamp expected to cost $25 million to $35 million. And those are just a couple of high-profile examples in a growing pool of renovations and revitalization.

For some, growth might seem to be the surest sign of golf’s health. But it’s investment in the form of improvements that’s more revealing.

About the NGF

About the NGF

Founded in 1936, the National Golf Foundation is a dynamic membership organization supported and trusted by thousands of golf related businesses and individuals who rely on NGF to provide the most up-to-date, accurate and objective insights on the state of the game and business of golf. It is the only trade association for everyone in the golf business, advocating for growth by educating and connecting its members. NGF is also the leading marketing services provider in golf, leveraging a database of 2.5 million golfers and the industry’s most comprehensive worldwide database of golf facilities. Additionally, NGF’s research arm works with individual companies to help them better understand their markets and grow their businesses. If you’re not among the hundreds of businesses that help support NGF’s ongoing research efforts through membership, we invite you to join the community.

Contact:

Erik Matuszewski

National Golf Foundation

Editorial Director

(561) 354-1637

(609) 577-0652

erikm@ngf.org