A “Big Idea” for Growing the Golfer Base: Lose Less

Few would argue with the general principle that business and industries grow by incrementally (or, in some cases, exponentially) adding to an existing base of customers, assets or resources. Back in the nascent days of Golf 20/20 when they decided to set initial targets, the goal was to get from (what they thought was) 35M to 55M participants in 20 years which Ruffin Beckwith defended at the time, in a media response to Pellucid’s contention that it was not achievable, as “maybe it’s too aggressive, maybe it’s not aggressive enough”. I have to admit that I couldn’t argue with that “logic”. While the program participation goal did turn out to be closer to my “delusional” vs. their “aspirational” description, I must give credit to the fact that the stated initiative growth components included both annually attracting 500K more golfers than the historical run rate and retaining 500K more than the historical attrition rate. The part that Tim Finchem & Co. “got right” 25 years ago was that golf was one of those industries (sports) that had a viable path to meaningful participant growth by attempting to “lose less” through increased focus on retention in concert with their inconsistent, underfunded flailings to produce a scalable, national player development program or system.

Fast forward to 2025 and the current growth trend in the golfer base, after we briefly “scared” going sub-20M in ’18, illustrates that what we got from the COVIDend was an inversion of the traditional business growth model. We’re attracting a lower number of new-to-sport golfers post-COVID but…the golfer base is growing because we’ve reduced defections (channeling one of Stuart Lindsay’s favorite terms) by roughly 50%. In one of the favorite terms of digital/website denizens, we’ve become “stickier” as a sport. In this issue, I’m going to focus on the less-publicized (less sexy) element of growing our participant base which isn’t player development (juniors, gender balancing, ethnic diversity etc.) but continuing the current trend of higher retention:

- What are the figures & trends of this attraction/attrition shift post-COVID?

- What are hypotheses to explain why golf has become “stickier”?

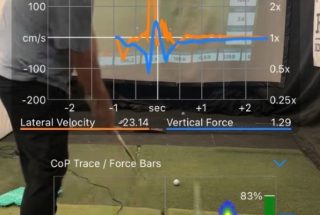

- What has changed in technology and methodology to enable a retention strategy and program?

What we now know in hindsight (what’s that saying, “Hindsight is always 20/20?”, I couldn’t resist) is that the technology and tools didn’t really exist 25 years ago for the illuminati to deliver on the strategy of improving participation by “losing less” short of instituting a successful, national golfer loyalty program that rewarded golfers for continued annual participation. Those tools (and Pellucid/Edgehill’s knowledge and successful, applied practices) now exist but we’ll have to attack the challenge from the bottom up. If individual owner/operators embrace this at even a reasonable adoption rate, Stuart and I might live long enough to see it show up in the annual national defector rate which will provide continued growth in the golfer base until/if the industry figures out the puzzle of player development that would move that needle at the national level.

For our subscribers, keep scrolling down to get the supporting facts and insights. For everyone else, you can get the rest of the story one of three ways:

- Subscribe to the comprehensive Pellucid Publications Membership for $495/yr or $45/mo (annual term), subscribers get access to the following:

- Outside the Ropes monthly digital newsletter

- Annual State of the Industry report & video (75-slide PowerPoint presentation plus online access to Jim/Stuart Orlando presentation video)

- Geographic Weather Impact Tracking (US, 45 regions, 61 markets) or Cognilogic for daily/monthly Golf Playable Hours/Capacity Rounds for individual facilities

- National Consumer Franchise Health Scorecard (expanded data and tables underlying this issue’s summary figures)

- Subscribe to OtR, 12 monthly issues for $250/yr or $25/mo (annual term), with a money-back guarantee if you’re not satisfied at any time during your subscription. Subscribers also get access to the historical archive of past issues (last two years) via the members-only section of the Pellucid website

- Subscribe to Golf Market Research Center (for operators wanting a combination of insights and action tools) – Here’s what’s included in an annual GMRC subscription for either $500 annual or $450 for NGCOA members (or $45/mo or $41/mo respectively):

- Full suite of Performance Tracking reports – Market profile, comparative trends report and 7 KPI scorecard for any month and Year-to-Date for data provided by facility

- Facility-level Cognilogic historical weather impact portal/reports access, Golf Playable Hours & Capacity Rounds by day in current month, by months in current year and by day-of-week in current year with comparisons to Year Ago and the 10-Yr Norm

- Facility-level Foresight 60-day Capacity Rounds forecast, select forecast weather elements (hi/lo temp, daily precip etc.), variance to last year and long-term Normal. Not infallible but better than guessing or trying to collect all that yourself and organize it manually…

- Outside the Ropes monthly e-newsletter (consider this a sample of topics and treatments)

- State of the Industry Presentation, report & video (75-slide PowerPoint presentation plus online access to Jim/Stuart Orlando presentation video)

To learn more:

- Click here for 2-page program overview or

- Click here for 15-minute video demo (you do have to register to see video; don’t worry, you’re not signing up for anything)

- Click here to subscribe for a single facility

- Email me for multiple facilities or special situations

As always, samples of all our publications, reports and services are available on the Reports and Services pages of the Pellucid website.

© Copyright 2025 Pellucid Corp. All rights reserved. Quotations permitted with prior approval. Material may not be reproduced, in whole or part in any form whatsoever, without prior written consent of Pellucid Corp.